If you’ve worked with business data or finance workflows, you know how chaotic invoicing can be. Invoices show up in every format such as PDFs, emails, scanned copies, and sometimes even handwritten notes. To make it even worse, each vendor has their own naming conventions, invoice numbers, and submission habits. And in the middle of all this? Duplicate invoices quietly sneak in, creating unexpected costs and payment errors.

So, if you’ve been searching for a simple, lasting solution to detect duplicate invoices and prevent them from happening in the future, you’re in the right place. In this blog, we’ll show you how to detect duplicate invoices without disrupting your existing processes.

Studies say that nearly 1 in 10 invoices are duplicates.

Keep reading till the end, and you’ll get to know:

- What duplicate invoices are

- How are invoice duplicates formed in the first place

- How to detect duplicate invoices (even the sneaky ones)

- How to prevent duplicate invoices through structural practices and automation, without overhauling your existing workflows

- A step-by-step solution to keep duplicate invoice issues from coming back in the future

Let’s get started.

What Are Duplicate Invoices?

A duplicate invoice is an invoice that appears twice in your system and risks being paid twice. But duplicates aren’t always exact copies.

Sometimes they’re sneaky:

- One invoice is “Invoice #1001” and another is “1001-A”

- Same vendor, same amount, different dates

- One’s from email, the other from snail mail

- A follow-up copy labeled “resubmitted” lands weeks later

Even a 2% duplicate rate on $75 million in AP invoices equals $1.5 million lost.

If your system, or your team, misses the overlap, you might end up paying both.

And it adds up. And the numbers are bigger than you think. Studies show that a 2% duplicate rate on $75 million in AP invoices equals $1.5 million lost. Surprised? There are more types of duplicate invoices than most teams realize. Not all of them are easy to spot, while some are obvious, others are much more deceptive.

Types of Duplicate Invoices

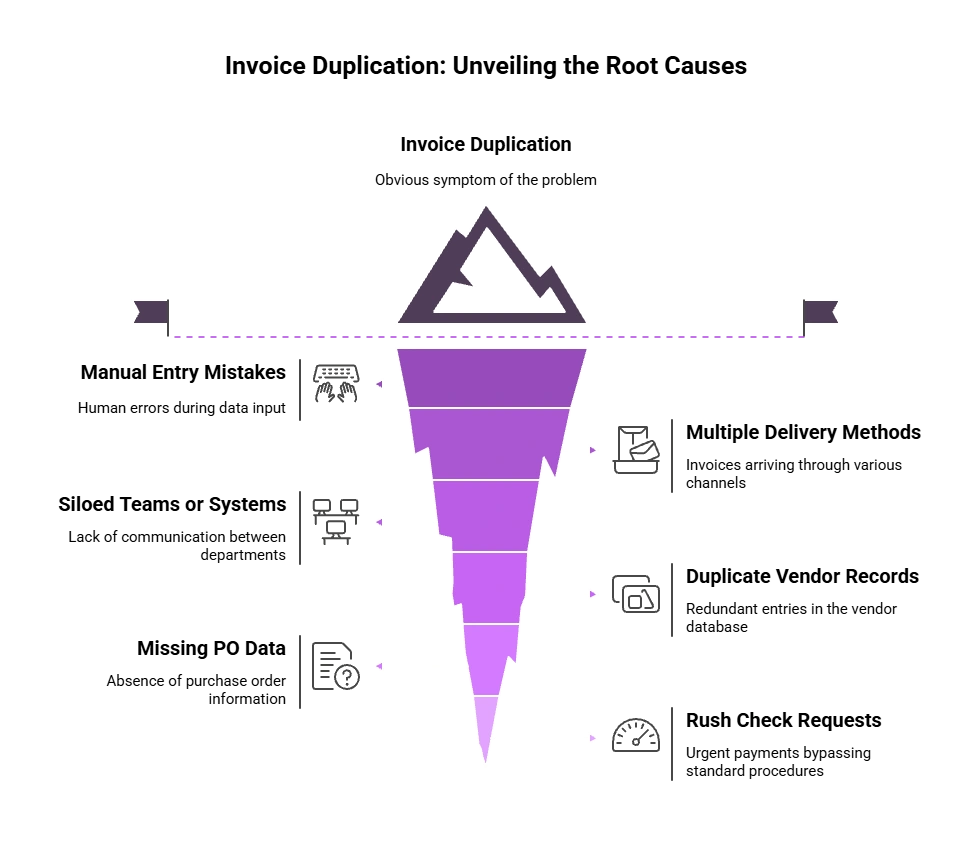

How Are Duplicate Invoices Created?

Most duplicates come from well-meaning people and broken processes, not fraud.

The Key Suspects of Invoice Duplication are:

1. Manual Entry Mistakes

Two team members enter the same invoice. Or one invoice is keyed in twice by mistake. Fatigue, volume, and time pressure make this common.

2. Multiple Delivery Methods

Vendors often send the same invoice by email, then again by mail, or via a portal upload. Sometimes they resend it just because the payment is delayed.

3. Siloed Teams or Systems

In big companies, one department pays an invoice, then another team pays it again because the systems don’t talk to each other.

4. Duplicate Vendor Records

“Acme Inc.” and “Acme Incorporated” might exist as separate vendors in your ERP. Invoices under both names slip past duplicate checks.

5. Missing Purchase Order or Reference Data

If an invoice isn’t linked to a PO or project number, it’s harder to trace and easier to process again unknowingly.

6. Rush Check Requests

Someone fast-tracks a payment. The original invoice comes later. Now AP processes that too, not realizing it’s already been paid.

Each of these errors is preventable, but only if you know how to spot them early.

How to Detect Duplicate Invoices with Structured Practices

You don’t have a take a huge leap all at once to detect duplicate invoices. You can still catch many duplicates with small, step-wise, and structured practices:

Compare Key Fields

Invoice number, vendor name, amount, and date. If these match another record, especially from the same vendor, you’ve got a suspect.

Search for Lookalikes

Watch for slight variations: “INV1001” vs “INV-1001” or “1001A” vs “1001.” Even minor formatting changes can confuse basic systems.

Match to POs and Receipts

If a PO has already been fully invoiced and received, a new invoice tied to it might be a repeat.

Centralized Invoice Intake

Use a single inbox or portal for all incoming invoices. Multiple entry points = duplicate risk.

Keep a Received Invoice Log

Track what comes in and when. Before entering a new invoice, check the log to see if it's already on file.

Train Your AP Team

Make invoice duplication a known issue. Set up red flags for your staff, like identical invoice amounts from the same vendor within a short window.

Run Periodic Audits

Use spreadsheets, ERP reports, or recovery audits to check historical data. Look for repeats and patterns that slip past day-to-day checks.

Manual detection works, but it’s not scalable. That’s where automation shines.

How to Detect Duplicate Invoices with Automation

Structured practices are often enough to prevent duplicate invoices. But if you’re part of a larger organization that processes thousands of invoices each month, you need stronger safeguards to protect your data and prevent financial leaks.

The good news? You don’t need to overhaul your entire data entry workflow. Today, intelligent systems can automate every step of your invoice process and proactively catch duplicate entries before they become a problem.

Here are some of the key stages where automation can detect and prevent duplicate invoices:

Step 1: Data Captured at Entry

As soon as an invoice is uploaded, whether it’s scanned, emailed, or submitted through a portal, integrate automation that extracts and structures all critical fields automatically, including:

- Invoice number

- Vendor name

- PO and GRN references

- Invoice date

- Amount and line items

No matter the format or layout, the data is instantly captured and ready for validation.

Step 2: Exact Match Checks

Immediately compare the new invoice against historical records in your system with a strong IDP tool. If all key fields (invoice number, vendor name, date, amount) match a previously processed invoice, it’s flagged as an exact duplicate and routed for review before it moves any further.

Step 3: Fuzzy Logic for Near-Matches

Not all duplicates are identical. Let AI do the fuzzy matching to catch near-duplicates that might have slight differences. For example:

- “INV1001” vs “INV-1001”

- “1001A” vs “1001”

- Same amount, same vendor, different date

Step 4: Automated Alerts and Review

When a duplicate or near-duplicate is detected, trigger automation that halts the invoice from proceeding to payment. At this stage, your team can:

- Review and validate flagged invoices

- Compare details side-by-side

- Approve, reject, or escalate based on business rules

- Track everything with a complete audit trail

How to Detect Duplicate Invoices with Infrrd’s Intelligent Document Processing for Invoices.

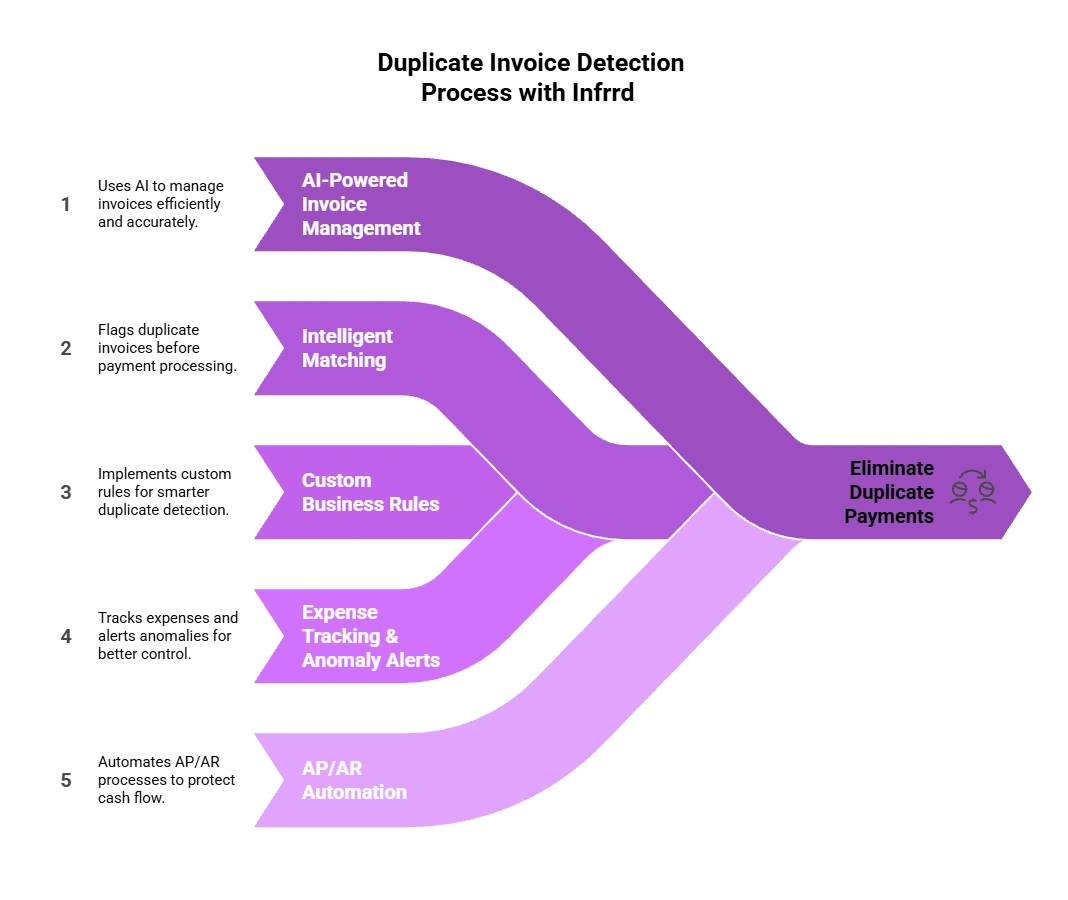

Here’s how Infrrd’s Invoice Document Processing Solution helps eliminate duplicate payments without disrupting your existing workflows.

1. AI-Powered Invoice Management

Infrrd for invoice extracts key data from any invoice, scanned, handwritten, tabular, or structured, and instantly validates it against existing records. By capturing every detail accurately at the point of entry, Infrrd reduces the risk of duplicate entries slipping through due to format variations or inconsistent naming.

2. Intelligent Matching to Flag Duplicates Before Payment

With automated 2-way, 3-way, and 4-way matching, Infrrd verifies invoices against purchase orders, goods receipts, and payment records. Even if an invoice has slight changes, like a revised number or updated date, the system detects it and prevents duplicate payments before approval.

3. Custom Business Rules for Smarter Detection

Not all duplicates are obvious. Some appear legitimate at first glance. Infrrd lets you build custom rules that account for your specific invoice formats, naming conventions, and business exceptions, helping your team catch duplicates that static systems would miss.

4. Effortless Expense Tracking & Anomaly Alerts

Infrrd categorizes and analyzes invoice data in real time, flagging irregularities like repeated charges from the same vendor or unusual patterns in amounts and frequency. These built-in alerts help your finance team investigate and stop duplicate charges before they make it into your reports.

5. AP/AR Automation That Protects Cash Flow

Duplicate invoices not only waste money, but they also disrupt your payment cycles. Infrrd’s end-to-end automation streamlines both AP and AR processes, giving you real-time visibility into cash flow, payment timing, and financial accuracy. By preventing duplicates before payment, Infrrd keeps your finances clean and predictable.

Why Finance Teams Trust Infrrd to Stop Duplicate Payments

What You DON’T Need to Do with Infrrd Invoice Duplication Prevention

❌ Redesign your ERP

❌ Change your invoice format

❌ Train vendors on a new process

Watch Infrrd’s Invoice Automation Platform in Action!

In a Nutshell

Duplicate invoices aren’t a one-off glitch. They’re a costly, recurring problem hiding in plain sight. Every time a vendor gets paid twice, it’s money lost, along with hours spent recovering it.

But you don’t need to overhaul your finance function to fix this.

Start by tightening your process:

- Standardize invoice intake

- Clean your vendor records

- Use PO matching

- Educate your team

- Run audits

Then, let automation handle the heavy lifting.

With the right system in place, your AP team becomes proactive, not reactive. You spot duplicates before they cost you, save your team hours, and keep your budget where it belongs.

No more guesswork. No more double pay. No more chaos.

Just clean, accurate, dependable invoice workflows—finally.

FAQs

Using AI for pre-fund QC audits offers the advantage of quickly verifying that loans meet all regulatory and internal guidelines without any errors. AI enhances accuracy, reduces the risk of errors or fraud, reduces the audit time by half, and streamlines the review process, ensuring compliance before disbursing funds.

Choose software that offers advanced automation technology for efficient audits, strong compliance features, customizable audit trails, and real-time reporting. Ensure it integrates well with your existing systems and offers scalability, reliable customer support, and positive user reviews.

Audit Quality Control (QC) is crucial for mortgage companies to ensure regulatory compliance, reduce risks, and maintain investor confidence. It helps identify and correct errors, fraud, or discrepancies, preventing legal issues and defaults. QC also boosts operational efficiency by uncovering inefficiencies and enhancing overall loan quality.

Mortgage review/audit QC software is a collective term for tools designed to automate and streamline the process of evaluating loans. It helps financial institutions assess the quality, compliance, and risk of loans by analyzing loan data, documents, and borrower information. This software ensures that loans meet regulatory standards, reduces the risk of errors, and speeds up the review process, making it more efficient and accurate.

Yes, AI can identify and extract changes in revised engineering drawings, tracking modifications to ensure accurate updates across all documentation.

Yes, advanced AI tools can recognize and extract handwritten annotations from engineering drawings, capturing important notes and revisions for further processing.