If you’ve worked with business data or finance workflows, you know how chaotic invoicing can be. Invoices show up in every format such as PDFs, emails, scanned copies, and sometimes even handwritten notes. To make it even worse, each vendor has their own naming conventions, invoice numbers, and submission habits. And in the middle of all this? Duplicate invoices quietly sneak in, creating unexpected costs and payment errors.

So, if you’ve been searching for a simple, lasting solution to detect duplicate invoices and prevent them from happening in the future, you’re in the right place. In this blog, we’ll show you how to detect duplicate invoices without disrupting your existing processes.

Studies say that nearly 1 in 10 invoices are duplicates.

Keep reading till the end, and you’ll get to know:

- What duplicate invoices are

- How are invoice duplicates formed in the first place

- How to detect duplicate invoices (even the sneaky ones)

- How to prevent duplicate invoices through structural practices and automation, without overhauling your existing workflows

- A step-by-step solution to keep duplicate invoice issues from coming back in the future

Let’s get started.

Wenn Sie mit Geschäftsdaten oder Finanzabläufen gearbeitet haben, wissen Sie, wie chaotisch die Rechnungsstellung sein kann. Rechnungen werden in allen Formaten wie PDFs, E-Mails, gescannten Kopien und manchmal sogar handschriftlichen Notizen angezeigt. Erschwerend kommt hinzu, dass jeder Anbieter seine eigenen Namenskonventionen, Rechnungsnummern und Einreichungsgewohnheiten hat. Und mittendrin? Doppelte Rechnungen schleichen sich leise ein und verursachen unerwartete Kosten und Zahlungsfehler.

Wenn Sie also nach einer einfachen, dauerhaften Lösung gesucht haben, um doppelte Rechnungen zu erkennen und zu verhindern, dass sie in Zukunft passieren, sind Sie hier richtig. In diesem Blog zeigen wir es Ihnen wie man doppelte Rechnungen erkennt ohne Ihre bestehenden Prozesse zu stören.

Studien sagen, dass fast 1 von 10 Rechnungen sind Duplikate.

Lesen Sie bis zum Ende weiter und Sie werden erfahren:

- Was sind Rechnungsduplikate

- Wie entstehen Rechnungsduplikate überhaupt?

- So erkennen Sie doppelte Rechnungen (auch die hinterhältigen)

- So verhindern Sie doppelte Rechnungen durch strukturelle Verfahren und Automatisierung, ohne Ihre bestehenden Arbeitsabläufe zu überarbeiten

- Eine schrittweise Lösung, um zu verhindern, dass Probleme mit doppelten Rechnungen in Zukunft erneut auftreten

Lass uns anfangen.

Was sind doppelte Rechnungen?

Eine doppelte Rechnung ist eine Rechnung, die zweimal in Ihrem System erscheint und die Gefahr besteht, dass sie zweimal bezahlt wird. Duplikate sind jedoch nicht immer exakte Kopien.

Manchmal sind sie hinterhältig:

- Eine Rechnung ist „Rechnung #1001“ und eine andere ist „1001-A“

- Gleicher Anbieter, gleicher Betrag, unterschiedliche Termine

- Einer ist aus E-Mail, der andere aus Schneckenpost

- Eine Folgekopie mit der Aufschrift „erneut eingereicht“ landet Wochen später

Sogar ein 2% doppelte Rate am 75$ Millionen an AP-Rechnungen entsprechen 1,5 Millionen $ verloren.

Wenn Ihr System oder Ihr Team die Überschneidung verpasst, zahlen Sie möglicherweise beide.

Und es summiert sich. Und die Zahlen sind größer als du denkst. Studien zeigen, dass ein 2% doppelte Rate am 75$ Millionen an AP-Rechnungen entsprechen 1,5 Millionen $ verloren. Überrascht? Es gibt mehr Arten doppelter Rechnungen, als den meisten Teams bewusst ist. Nicht alle von ihnen sind leicht zu erkennen, während einige offensichtlich sind, während andere viel trügerischer sind.

Arten doppelter Rechnungen

Wie werden doppelte Rechnungen erstellt?

Die meisten Duplikate stammen von wohlmeinenden Personen und kaputten Prozessen, nicht von Betrug.

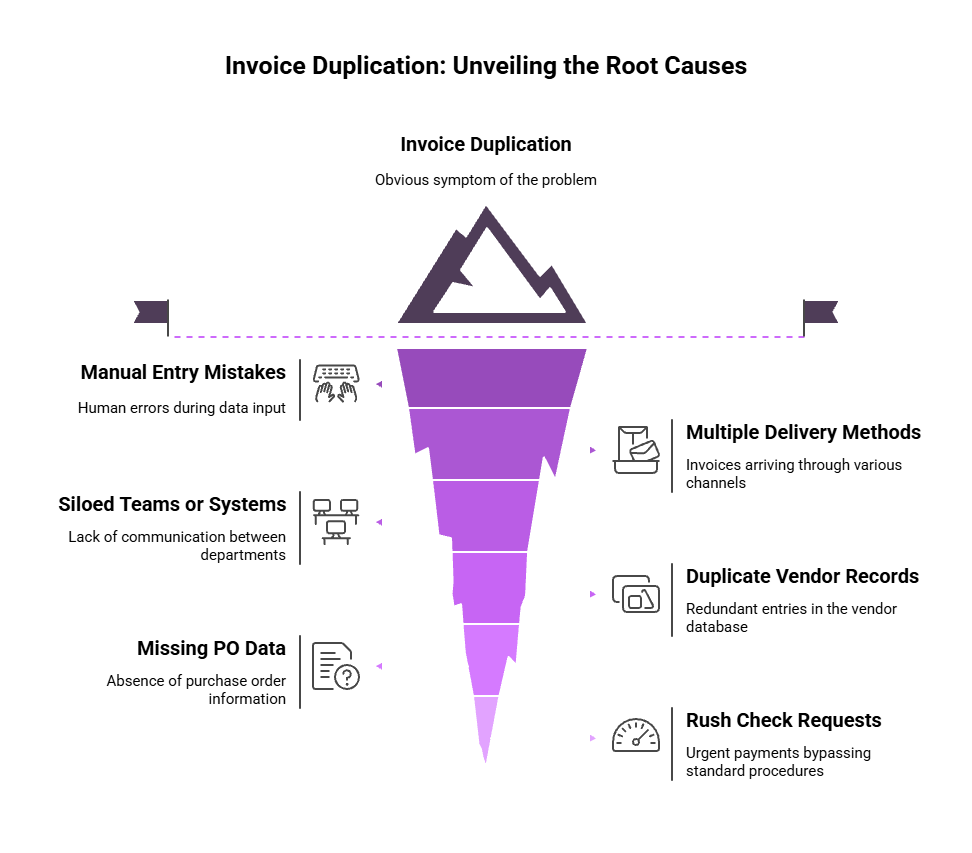

Die Hauptverdächtigen der Rechnungsduplizierung sind:

1. Fehler bei der manuellen Eingabe

Zwei Teammitglieder geben dieselbe Rechnung ein. Oder eine Rechnung wird versehentlich zweimal eingegeben. Müdigkeit, Volumen und Zeitdruck machen das häufig.

2. Mehrere Versandmethoden

Anbieter senden häufig dieselbe Rechnung per E-Mail, dann erneut per Post oder über einen Portal-Upload. Manchmal senden sie es erneut, nur weil sich die Zahlung verzögert.

3. Isolierte Teams oder Systeme

In großen Unternehmen bezahlt eine Abteilung eine Rechnung, dann bezahlt ein anderes Team sie erneut, weil die Systeme nicht miteinander kommunizieren.

4. Doppelte Lieferantendatensätze

„Acme Inc.“ und „Acme Incorporated“ sind möglicherweise als separate Anbieter in Ihrem ERP enthalten. Rechnungen, die beide Namen tragen, werden doppelt ausgestellt.

5. Fehlende Bestell- oder Referenzdaten

Wenn eine Rechnung nicht mit einer Bestell- oder Projektnummer verknüpft ist, ist sie schwieriger nachzuverfolgen und kann leichter unwissentlich erneut bearbeitet werden.

6. Anfragen zur Schnellüberprüfung

Jemand beschleunigt eine Zahlung. Die Originalrechnung kommt später. Jetzt verarbeitet AP das auch, ohne zu merken, dass es bereits bezahlt wurde.

Jeder dieser Fehler ist vermeidbar, aber nur, wenn Sie wissen, wie Sie sie frühzeitig erkennen können.

So erkennen Sie doppelte Rechnungen mit strukturierten Verfahren

Sie müssen nicht auf einmal einen großen Sprung machen, um doppelte Rechnungen zu erkennen. Mit kleinen, schrittweisen und strukturierten Verfahren können Sie immer noch viele Duplikate erkennen:

Schlüsselfelder vergleichen

Rechnungsnummer, Name des Anbieters, Betrag und Datum. Wenn diese mit einem anderen Datensatz übereinstimmen, insbesondere von demselben Anbieter, haben Sie einen Verdächtigen.

Suche nach Lookalikes

Achten Sie auf geringfügige Abweichungen: „INV1001" gegen „INV-1001" oder „1001A“ gegen „1001". Selbst geringfügige Formatierungsänderungen können grundlegende Systeme verwirren.

Mit Bestellungen und Quittungen abgleichen

Wenn eine Bestellung bereits vollständig in Rechnung gestellt und eingegangen ist, kann es sich bei einer damit verbundenen neuen Rechnung um eine Wiederholung handeln.

Zentralisierter Rechnungseingang

Verwenden Sie einen einzigen Posteingang oder ein Portal für alle eingehenden Rechnungen. Mehrere Einstiegspunkte = doppeltes Risiko.

Führen Sie ein Protokoll über eingegangene Rechnungen

Verfolgen Sie, was wann eingeht. Bevor Sie eine neue Rechnung eingeben, überprüfen Sie im Protokoll, ob sie bereits hinterlegt ist.

Trainiere dein AP-Team

Machen Sie das Duplizieren von Rechnungen zu einem bekannten Problem. Richten Sie Warnsignale für Ihre Mitarbeiter ein, z. B. identische Rechnungsbeträge desselben Anbieters innerhalb eines kurzen Zeitfensters.

Führen Sie regelmäßige Audits durch

Verwenden Sie Tabellen, ERP-Berichte oder Recovery-Audits, um historische Daten zu überprüfen. Halten Sie Ausschau nach Wiederholungen und Mustern, die den täglichen Kontrollen entgehen.

Die manuelle Erkennung funktioniert, ist aber nicht skalierbar. Das ist der Punkt, an dem die Automatisierung glänzt.

So erkennen Sie doppelte Rechnungen mit Automatisierung

Oft reichen strukturierte Verfahren aus, um doppelte Rechnungen zu vermeiden. Wenn Sie jedoch Teil einer größeren Organisation sind, die jeden Monat Tausende von Rechnungen bearbeitet, benötigen Sie stärkere Sicherheitsvorkehrungen, um Ihre Daten zu schützen und Finanzlecks zu verhindern.

Die gute Nachricht? Sie müssen nicht Ihren gesamten Dateneingabe-Workflow überarbeiten. Heute können intelligente Systeme jeden Schritt Ihres Rechnungsprozesses automatisieren und doppelte Eingaben proaktiv erkennen, bevor sie zu einem Problem werden.

Hier sind einige der wichtigsten Phasen, in denen die Automatisierung doppelte Rechnungen erkennen und verhindern kann:

Schritt 1: Bei der Eingabe erfasste Daten

Sobald eine Rechnung hochgeladen wird, egal ob sie gescannt, per E-Mail versendet oder über ein Portal eingereicht wurde, integrieren Sie eine Automatisierung, die alle wichtigen Felder automatisch extrahiert und strukturiert, einschließlich:

- Nummer der Rechnung

- Name des Anbieters

- PO- und GRN-Referenzen

- Datum der Rechnung

- Betrag und Einzelposten

Unabhängig vom Format oder Layout werden die Daten sofort erfasst und stehen zur Validierung bereit.

Schritt 2: Exakte Match-Checks

Vergleichen Sie die neue Rechnung sofort mit historischen Aufzeichnungen in Ihrem System mit einem starkes IDP-Tool. Wenn alle wichtigen Felder (Rechnungsnummer, Lieferantenname, Datum, Betrag) mit einer zuvor verarbeiteten Rechnung übereinstimmen, wird sie als gekennzeichnet genaues Duplikat und zur Überprüfung weitergeleitet, bevor es weiter geht.

Schritt 3: Fuzzy-Logik für Near-Matches

Nicht alle Duplikate sind identisch. Lassen Sie KI das machen Fuzzy-Matching um Beinahe-Duplikate zu fangen, die geringfügige Unterschiede aufweisen könnten. Zum Beispiel:

- „INV1001“ gegen „INV-1001“

- „1001A“ gegen „1001“

- Gleiche Menge, gleicher Lieferant, anderes Datum

Schritt 4: Automatisierte Benachrichtigungen und Überprüfung

Wenn ein Duplikat oder fast ein Duplikat erkannt wird, lösen Sie eine Automatisierung aus, die verhindert, dass die Rechnung zur Zahlung weitergeleitet wird. In dieser Phase kann Ihr Team:

- Überprüfen und validieren Sie markierte Rechnungen

- Details Seite an Seite vergleichen

- Genehmigen, ablehnen oder eskalieren Sie auf der Grundlage von Geschäftsregeln

- Verfolgen Sie alles mit einem vollständigen Audit-Trail

So erkennen Sie doppelte Rechnungen mit der intelligenten Dokumentenverarbeitung für Rechnungen von Infrrd.

So funktioniert Infrarot Lösung zur Verarbeitung von Rechnungsdokumenten hilft dabei, doppelte Zahlungen zu vermeiden, ohne Ihre bestehenden Arbeitsabläufe zu stören.

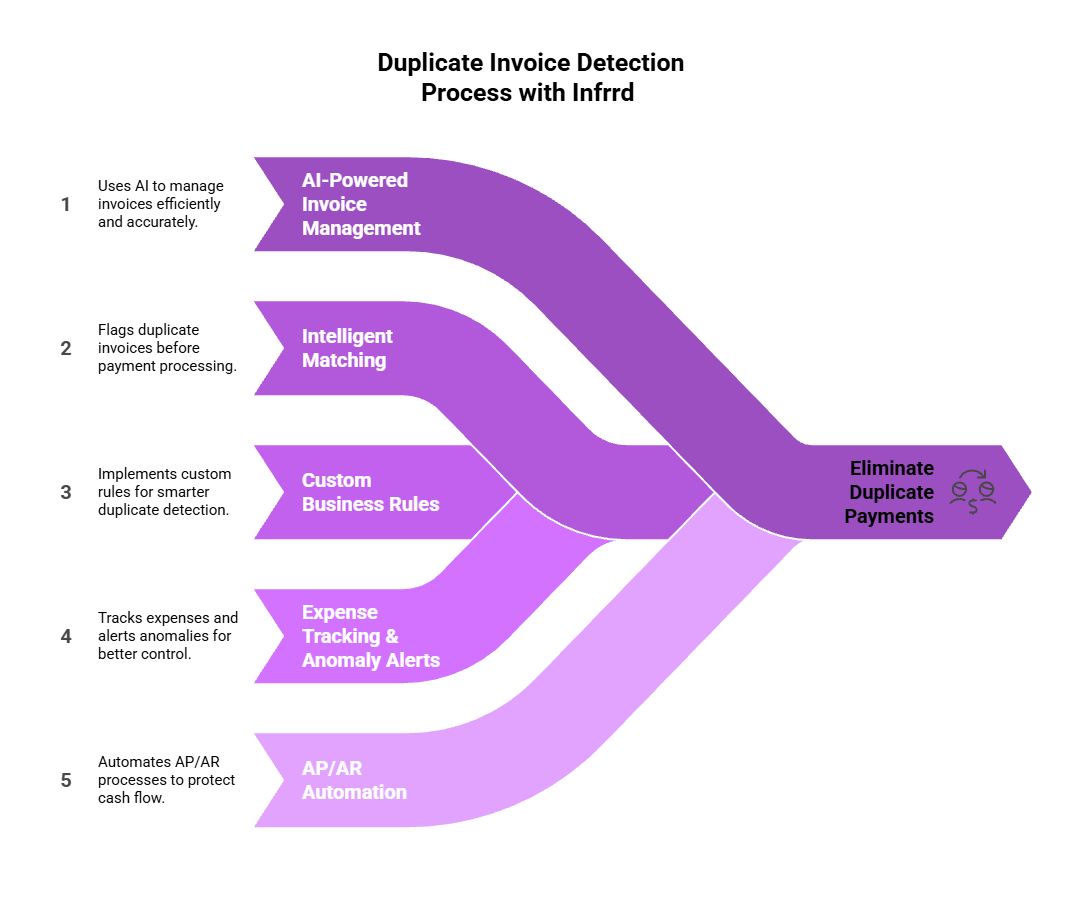

1. KI-gestütztes Rechnungsmanagement

Infrarot für Rechnung extrahiert wichtige Daten aus jeder Rechnung, gescannt, handschriftlich, tabellarisch oder strukturiert und validiert es sofort anhand vorhandener Aufzeichnungen. Infrrd erfasst jedes Detail bei der Eingabe genau und reduziert so das Risiko, dass doppelte Einträge aufgrund von Formatvariationen oder inkonsistenten Benennungen durchrutschen.

2. Intelligenter Abgleich, um Duplikate vor der Zahlung zu kennzeichnen

Mit automatisiert 2-Wege, 3-Wege und 4-Wege Beim Abgleich überprüft Infrrd Rechnungen anhand von Bestellungen, Wareneingängen und Zahlungsaufzeichnungen. Selbst wenn eine Rechnung geringfügige Änderungen aufweist, wie z. B. eine überarbeitete Nummer oder ein aktualisiertes Datum, erkennt das System dies und verhindert doppelte Zahlungen vor der Genehmigung.

3. Benutzerdefinierte Geschäftsregeln für intelligentere Erkennung

Nicht alle Duplikate sind offensichtlich. Einige erscheinen auf den ersten Blick legitim. Mit Infrrd können Sie benutzerdefinierte Regeln erstellen, die Ihre spezifischen Rechnungsformate, Namenskonventionen und Geschäftsausnahmen berücksichtigen. So können Sie Ihrem Team helfen, Duplikate zu erkennen, die statische Systeme übersehen würden.

4. Mühelose Spesenverfolgung und Warnmeldungen bei Unregelmäßigkeiten

Infrarot-Kategorien und analysiert Rechnungsdaten in Echtzeit, Aufzeigen von Unregelmäßigkeiten wie wiederholten Abbuchungen durch denselben Anbieter oder ungewöhnliche Muster in Höhe und Häufigkeit. Diese integrierten Benachrichtigungen helfen Ihrem Finanzteam dabei, doppelte Abbuchungen zu untersuchen und zu verhindern, bevor sie in Ihre Berichte aufgenommen werden.

5. AP/AR-Automatisierung, die den Cashflow schützt

Doppelte Rechnungen verschwenden nicht nur Geld, sondern stören auch Ihre Zahlungszyklen. Die durchgängige Automatisierung von Infrrd optimiert sowohl AP- als auch AR-Prozesse und bietet Ihnen in Echtzeit einen Überblick über den Cashflow, den Zahlungszeitpunkt und die finanzielle Genauigkeit. Indem es Duplikate vor der Zahlung verhindert, sorgt Infrrd dafür, dass Ihre Finanzen sauber und vorhersehbar sind.

Warum Finanzteams darauf vertrauen, dass Infrrd doppelte Zahlungen verhindert

Was Sie mit dem Schutz vor Duplikaten von Infrarotrechnungen NICHT tun müssen

❌ Gestalten Sie Ihr ERP neu

❌ Ändere dein Rechnungsformat

❌ Schulen Sie Anbieter in einem neuen Prozess

Sehen Sie sich die Rechnungsautomatisierungsplattform von Infrrd in Aktion an!

Auf den Punkt gebracht

Doppelte Rechnungen sind kein einmaliger Fehler. Sie sind ein kostspieliges, wiederkehrendes Problem, das sich vor aller Augen versteckt. Jedes Mal, wenn ein Anbieter zweimal bezahlt wird, geht Geld verloren, zusammen mit Stunden, die damit verbracht werden, es wiederherzustellen.

Sie müssen Ihre Finanzfunktion jedoch nicht überarbeiten, um dies zu beheben.

Beginnen Sie mit der Straffung Ihres Prozesses:

- Standardisieren Sie den Rechnungseingang

- Bereinigen Sie Ihre Lieferantendaten

- PO-Abgleich verwenden

- Bilden Sie Ihr Team aus

- Audits durchführen

Lassen Sie dann die Automatisierung die schwere Arbeit erledigen.

Mit dem richtigen System wird Ihr AP-Team proaktiv, nicht reaktiv. Sie erkennen Duplikate, bevor sie Sie kosten, sparen Ihrem Team Stunden und behalten Ihr Budget dort, wo es hingehört.

Kein Rätselraten mehr. Keine doppelte Bezahlung mehr. Kein Chaos mehr.

Einfach saubere, genaue und zuverlässige Rechnungsabläufe — endlich.

Häufig gestellte Fragen

Software zur Überprüfung und Prüfung von Hypotheken ist ein Sammelbegriff für Tools zur Automatisierung und Rationalisierung des Prozesses der Kreditbewertung. Es hilft Finanzinstituten dabei, die Qualität, die Einhaltung der Vorschriften und das Risiko von Krediten zu beurteilen, indem sie Kreditdaten, Dokumente und Kreditnehmerinformationen analysiert. Diese Software stellt sicher, dass Kredite den regulatorischen Standards entsprechen, reduziert das Fehlerrisiko und beschleunigt den Überprüfungsprozess, wodurch er effizienter und genauer wird.

KI verwendet Mustererkennung und Natural Language Processing (NLP), um Dokumente genauer zu klassifizieren, selbst bei unstrukturierten oder halbstrukturierten Daten.

Wählen Sie eine Software, die fortschrittliche Automatisierungstechnologie für effiziente Audits, leistungsstarke Compliance-Funktionen, anpassbare Audit-Trails und Berichte in Echtzeit bietet. Stellen Sie sicher, dass sie sich gut in Ihre vorhandenen Systeme integrieren lässt und Skalierbarkeit, zuverlässigen Kundensupport und positive Nutzerbewertungen bietet.

Audit Quality Control (QC) ist für Hypothekenunternehmen von entscheidender Bedeutung, um die Einhaltung gesetzlicher Vorschriften sicherzustellen, Risiken zu reduzieren und das Vertrauen der Anleger zu wahren. Es hilft dabei, Fehler, Betrug oder Unstimmigkeiten zu erkennen und zu korrigieren und so rechtliche Probleme und Zahlungsausfälle zu vermeiden. QC steigert auch die betriebliche Effizienz, indem Ineffizienzen aufgedeckt und die allgemeine Kreditqualität verbessert wird.

Der Einsatz von KI für QC-Audits vor der Finanzierung bietet den Vorteil, dass schnell und fehlerfrei überprüft werden kann, ob Kredite alle regulatorischen und internen Richtlinien erfüllen. KI erhöht die Genauigkeit, reduziert das Risiko von Fehlern oder Betrug, reduziert die Prüfungszeit um die Hälfte und rationalisiert den Überprüfungsprozess, sodass die Einhaltung der Vorschriften vor der Auszahlung von Geldern sichergestellt wird.

Ja, KI kann Änderungen in überarbeiteten Konstruktionszeichnungen erkennen und extrahieren und Änderungen verfolgen, um genaue Aktualisierungen in der gesamten Dokumentation sicherzustellen.