Versicherungsformulare für Hausbesitzer sind der erste Schritt, um das zu schützen, was die Menschen am meisten schätzen, ihr Zuhause. Aber wenn sie jemals mit einem umgegangen sind AKKORD 80 von Hand formen, du kennst den Knauf. Agenten jonglieren mit dichtem Papierkram, die Dateneingabe kostet Stunden und die Genauigkeit hängt vom menschlichen Fokus ab. Multiplizieren Sie das mit hunderten oder tausenden von Richtlinien, und der Prozess wird zu einem betrieblichen Zustand.

The Automation changes this history. Mit Intelligent Document Processing (IDP), Versicherer können ACORD 80-Formulare schneller, mit weniger Fehlern und besseren Einblicken verarbeiten.

In diesem Handbuch erfahren Sie, was ACORD 80 ist, warum es wichtig ist, wie die Automatisierung vereinfacht ist und wie Infrarot macht die Transformation real.

Was ist ACORD 80?

AKKORD 80, bekannt als Antragsformular für Hausbesitzer, is a standard document, that is used in the whole insurance industry. Es zeichnet wichtige Details aus wie:

- Antragssteller- und Objektinformationen

- Deckungssummen und -grenzen

- Selbstbehalte und optionale Vermerke

- Previous loss history and insurance protection

- Zusätzliche Zinsen, wie Hypotheken oder Pfandgläubiger

Created by EINVERNEHMEN (Verein für kooperative Betriebsforschung und Entwicklung), this form standardisiert die Daten von Hausbesitzern, sodass Versicherer, Makler und Vertreter klar kommunizieren können.

Sie stellen sich als eine universelle Versicherungssprache vor, die jeder Interessengruppen versteht.

Warum ACORD 80 in der Hausbesitzerversicherung wichtig ist

Die Hausbesitzer-Linie bewegt ein hohes Prämienvolumen in den Vereinigten Staaten. Die NAIV published schnappschüsse to market parts and premium, which show the size of the tax insurance market and the anteil of leading insurance. This reports help them to use the chance of process profits.

The market pressure is also. Im Januar 2025, 7 Tage Bundesversicherungsamt des US-Finanzministeriums berichtete, dass die Hausbesitzerversicherung geworden ist teurer und schwieriger zu beschaffen in vielen Bereichen, basierend auf landesweiten Daten von Hunderten von Versicherern und Millionen von Polizisten. This signal increased the value a quickly, sauberer aufnahme.

Wenn ACORD 80 klar und vollständig ist, geht das Underwriting schnell voran. Wenn ACORD 80 unordentlich ist oder zu spät kommt, verlangsamt sich alles. The quality of the formulars gives the ton, when it goes to speed, price accuracy and auditbereitschaft.

Anatomie des ACORD 80-Formulars

Vor der Automatisierung müssen Sie wissen, was Sie automatisieren. Hier ist eine kurze Aufschlüsselung der ACORD 80-Struktur:

- Information to Agency and Spediteur — Agenturcode, Name des Spediteurs, Gültigkeits- und Ablaufdatum sowie Art der Polizei.

- Information for bewerber — Name, Adresse und Kontaktdaten des Versicherten.

- Angaben zur Immobilie — Bauart, Dachalter, Wärmequelle und Sicherheitsmerkmale.

- Information zur Deckung — Deckungssummen für Wohnung, Privateigentum, Haftung und Nutzungsausfall.

- Selbstbehalte — Gewählter Selbstbehalt pro Deckungsart.

- Frühere Versicherung/ Schadenhistorie — Frühere Fluggesellschaften, Verjährungsfristen und Ansprüche.

- Optionale Deckungen/Vermerke — Zusätzliche Schutzmaßnahmen wie Überschwemmung, Diebstahl oder Geräteausfall.

- Payment Plan and Premium — Zahlungshäufigkeit, Gesamtprämie und Finanzierungshinweise.

- Additional Interesses — Angaben zum Hypothekeninhaber, Pfandinhaber oder zu anderen interessierten Parteien.

- Notations and Systems — Zusätzliche Dokumente, Offenlegungen oder Anmerkungen.

Jedes Feld interagierte mit anderen. If they also select „second residence“, change the risk einstufung. Wenn Sie „Holzofen“ hinzufügen, ist möglicherweise ein Sicherheitshinweis erforderlich. Ein gutes Automatisierungssystem versteht diese Abhängigkeiten.

Das Problem mit der manuellen ACORD 80-Verarbeitung

Manuell fühlt es sich bei zehn Formen harmlos an. Bei tausend verlangsamt es den Raum. Die Zeit vergeht, ein Fehler schleichen sich ein und Ihr Audit-Trail beginnt zu fransen.

1. Langsamer Turnaround

The manual ACORD 80-processing takes time in claim.

The read, enter and check a formulars can take 10—20 minutes. If they scale on hunderte or 10,000 of inputs, minutes to long time, checks, and the operating efficiency sinkt. Das Ergebnis? Langsamere Reaktionszeiten für Kunden und verzögertes Underwriting oder Policenausstellung.

2. Vermeidbare Fehler

The receive Human Data has lead to inconsistences and fehlern.

Tippfehler, übersehene Checkboxen und falsch platzierte Ziffern verschwinden oft selbst bei den sorgfältigsten Bewertungen. This little errors lead to significant subsequent work, assigned einreichings and ending e-mail schleifen between maklern and spediteures. What have a single check, will to several correcture rundes.

3. Inkonsistente Daten

Different people interpret and give data different.

Wenn mehrere Prozessoren formulare verarbeiten, können die Feldeinträge variieren. Einer könnte „CA“ eingeben, ein anderer „Kalifornien“. Im Laufe der Zeit führen diese kleinen Inkonsistenzen dazu, dass Datensätze nicht systemübergreifend übereinstimmen. This does to widersprüchlichen reports, including analysis and verwirrung with abgleich of policy-data.

4. Fehlende Informationen

Unvollständige Einreichungen verlangsamen Entscheidungen und bergen Risiken.

Ein fehlender Anhang, ein ungefüllter Verlustbetrag oder eine übersprungene Seite kann einen ganzen Fall zum Scheitern bringen. The teams take then to hours that, out, was noch fehlt, anstatt to editing application. This verzögert nicht nur das Underwriting, sondern erhöht auch das Compliance-Risiko, wenn die Dokumentation nicht vollständig ist.

5. Wackeliger Audit-Trail

Manuelle Änderungen hinterlassen keine zuverlässigen Spuren.

Changes are often in emails, handwritten notes or tables without tracking. If auditors back, there there no critical recording about, who was changed has or why. This significant compliance checks, set company risks from and undergräbt the confidence in their data.

McKinsey zeigt, dass eine gut funktionierende Automatisierung von Versicherungs- und Kostenträgern die Betriebskosten senken kann, indem ungefähr 30% über ein paar Jahre. Short the second tip on ACORD 80 and they kürzen touch, error and days, to abkürzen the zitat.

Was blockiert den Fortschritt? Deloitte weist auf drei Schuldige hin: Integrationsprobleme (62%), Qualifikationslücken (55%), und Process change (52%). Korrigiere sie in dieser Reihenfolge: verbinden Sie Ihre Systeme, trainiere deine Leute, aktualisiere den Arbeitsablauf, und die manuelle Eingabe wird die Leistung Ihres Unternehmens nicht mehr dominieren.

So automatisieren Sie ACORD 80

Automation means not, employees to replace; es bedeutet, wiederkehrende Tasks zu eliminieren, sodass Ihr Team sich auf Urteilsvermögen und Kundenservice konzentrieren kann. So funktioniert Infrarot-IDP A work process processed in the rule the ACORD 80 processing.

Schritt 1: Das Formular aufnehmen

Users load ACORD 80files high: PDFs, Scans or images over a portal or a api. Infrord akzeptiert verschiedene Datentypen und sogar Massen-Uploads.

Schritt 2: Reinigen und vorbereiten

The platform corrects the schräglage, verbessert die bildschärfe und richtet den Text für eine bessere Erkennung aus.

Schritt 3: Ermitteln Sie das Layout

AI identified the document type (ACORD 80) and his version. Parts like „Versicherungsschutz“, „Schadenverlauf“ und „Selbstbehalte“ werden automatisch erkannt.

Schritt 4: Expite the data

Optische Zeichenerkennung (OCR) and KI models read text and numeric fields. Adaptive Extractions Models of Infrared Contextual Inference, to improve the accuracy, by handwritten scans or scans with low resolution.

Schritt 5: Dem Datenschema zuordnen

Extrated values are assigned structure data areas, for example Wohnung = 400.000$, Selbstbehalt = 1.000 USD.

Schritt 6: Validieren und Markieren

Integrated Rules kennzeichnen Inkonsistenzen:

- Selbstbehalt höher als Deckung

- Ungültige Postleitzahl oder nicht übereinstimmendes Bundesland

- Fehlende Signaturen oder Anlagen

Schritt 7: Mensch im Kreis

Auditoren checken markierte Felder über die Maker-Checker-Schnittstelle von Infrrd und stellen sicher, dass die Datenintegrität vor der Einreichung gewährleistet ist.

Schritt 8: Export and Integrate

Saubere Daten werden über sichere APIs in Underwriting-, CRM- oder Policensysteme übertragen. Zu den Exportoptionen gehören JSON, Excel oder XML.

Schritt 9: Kontinuierliches Lernen

Jede Korrektur verbessert die Modellleistung. Das System lernt und wird mit der Zeit genauer.

Benefits of Automation by ACORD 80

Insofern profitieren Versicherer und Agenturen von der Automatisierung:

1. Zeitliche Effizienz

Was bedeutet das: The automatic data extraction reduced the processing time of ACORD forms from minutes to seconds.

Warum es wichtig ist: Ein mittelständischer Versicherungsträger, der rund 10.000 Anträge pro Jahr bearbeitet, kann mehr als sparen 2.500 Workhoursso dass die Mitarbeiter in Underwriting and the Customer Service konzentrieren können, anstatt sich wiederholend mit der Dateneingabe zu befassen.

2. Excuracy and consistency

Was bedeutet das: Durch die Automatisierung werden manuelle Übertragungsfehler vermieden und vordefinierte Validierungsregeln für jedes Feld angewendet.

Warum es wichtig ist: Jede Eingabe wird in einem einheitlichen Format erfasst, wodurch die Nacharbeit und die Dateninkongruenzen zwischen den Systemen reduziert werden — eine wichtige Voraussetzung für fehlerfreie Berichterstattung und nachgelagerte Analysen.

3. Reduzierung der Kosten

Was bedeutet das: Durch den Wegfall manueller Überprüfungen und die Reduzierung der Wiederaufbereitung senkt die Automatisierung direkt die Betriebskosten.

Warum es wichtig ist: Laut McKinsey, intelligente Automatisierung kann die Verarbeitungskosten senken, indem bis zu 30% in Versicherungsabäufen.

4. Skalierbarkeit

Was bedeutet das: Automatisierte Systeme können Volumenspitzen bewältigen, ohne dass mehr Personal erforderlich ist.

Warum es wichtig ist: Wenn die Anzahl der Einreichungen steigt, z. B. bei Verlängerungen oder bei saisonalen Überlastungen, bleibt die Verarbeitungsgeschwindigkeit konstant, sodass Geschäftskontinuität und zeitnahe Antworten gewährleistet sind.

5. Bessere Einhaltung der Vorschriften

Was bedeutet das: Jede automatisierte Aktion wird mit Zeitstempel, Benutzer-IDs und Versionshistorien protokolliert.

Warum es wichtig ist: This integrated audit trail simplify administration checks and provides for complete transparence by conformity checks.

6. Besseres Kundenerlebnis

Was bedeutet das: Automatisierte Workflows liefern schneller Angebote und politische Entscheidungen.

Warum es wichtig ist: Quicker processing times improve the customer satisfaction and lead to high customer binding and extension rates for insurers.

7. Umsetzbare Erkenntnisse

Was bedeutet das: Structure and standardized data can be analysis to identify pattern as risk position, adenshäufigkeit and deckungslücken.

Warum es wichtig ist: Teams können intelligente Entscheidungen treffen, die Preisgenauigkeit verbessern und Betrug frühzeitig erkennen, was einen langfristigen Wettbewerbsvorteil verschwendet.

Herausforderungen bei der Automatisierung von ACORD 80

Jedes Technologieprojekt hat Hürden. Hier sind die häufigsten Probleme, mit denen die Versicherer konfrontiert sind:

1. Variantes de formulars

Jeder Versicherungsträger passt zu seinem ACORD- oder internen Formularlayout, indem Feldnamen, Positionen leicht geändert oder zusätzliche Abschnitte hinzugefügt werden. This variation is used for standard OCR or rule based systems, data to accurate extract. KI-gestützte Dokumentenverarbeitungsmodelle, die auf mehreren Formaten trainiert wurden, können diese Layoutunterschiede erkennen und die Genauigkeit bei allen Herstellern aufrechterhalten.

2. Scans von geringer Qualität

Viele ACORD-Formulare kommen immer noch als Faxe oder Kopien mit niedriger Auflösung, wodurch der Text häufig verwischt und die Felder verzerrt werden. Bilder mit schlechterer Qualität verringern die Genauigkeit der Datenextraktion und verlängern den Zeitaufwand für die manuelle Überprüfung. Fortschrittliche IDP-Plattformen (Intelligent Document Processing) bewältigen diese Herausforderung mithilfe von Techniken zur Bildverbesserung, Verzerrungsreduzierung und Rauschreduzierung, die die Klarheit wiederherstellen und die Erkennungsgenauigkeit verbessern.

3. Handschriftliche Eingaben

Versicherungsformulare enthalten häufig handschriftliche Abschnitte, insbesondere für Unterschriften, Verlustnotizen und zusätzliche Kommentare. Standard-OCR-Systeme haben Probleme mit diesen Eingaben, da der Handschriftstil und die Lesbarkeit unterschiedlich sind. Moderne Handschrifterkennung, die auf neuronalen Netzwerken basiert, kann kursive und gemischte Texte so interpretieren, dass Versicherer vollständige und genaue Daten automatisch erfassen können.

4. Perditional logic

ACORD and additional forms includes often dependent questions, with which a response defined which fields are displayed as next. If they also example with „Yes“ response, you may have additional documents to hang or fill a additional section. Simple Automation Tools übersehen diese Abhängigkeiten, während KI-Systeme mit kontextbezogenem Verständnis diese logischen Zusammenhänge erkennen und sicherstellen, dass keine Daten übertragen oder falsch interpretiert werden.

5. Datenschutz

Insurance operations include sensitive customer data, which are protected by rules as HIPAA, GLBA and different state privacy laws. Automationsplattformen müssen die Einhaltung der Vorschriften durch Verschlüsselung, Zugriffskontrollen und detaillierte Auditprotokolle gewährleisten. Eine starke Datenverwaltung verhindert nicht nur regulatorische Probleme, sondern schafft auch Vertrauen bei Versicherungsnehmern und Partnern.

6. Verwaltung von Änderungen

The introduction of technologies is often on resistance, when teams are used to manual working processes. Unangemessene Bearbeitung und Schulung zögern Mitarbeiter möglicherweise, auf Automatisierung zu verzichten. Ein gut strukturierter Change-Management-Prozess, der Kommunikation, Benutzerschulung und messbare Erfolgskontrolle kombiniert, gewährleistet eine reibungslose Einführung und dauerhafte Produktivitätssteigerungen.

The platform of Infrrd mildert this by flexible vorlagenerkennung, handschriftmodelle und sicheres Cloud-Hosting with full verschlüsselung.

Metrics for success measurement

Die Verfolgung der richtigen Kennzahlen stellt sicher, dass der ROI sichtbar und messbar ist:

Mit IDP sehen Versicherer in der Regel Reduzierung der manuellen Berührungsrate um 90% innerhalb von Monaten nach dem Einsatz.

For ACORD 80 Automation build or buy

Inhouse bauen

- Benefits: Volle Kontrolle und Anpassung.

- Nights: Erfordert qualifizierte Datenwissenschaftler, OCR-Ingenieure und kontinuierliche Updates.

Kaufen/Partner

- Benefits: schnellere einrichtung, bewährte modelle, geringerer wartungsaufwand.

- Nights: Recommending license costs.

For the most central and great insurers is the cooperation with a bewährten IDP provider as Infrarot sorgt für einen schnelleren ROI und sorgt dafür, dass interne Teams sich auf Underwriting und Strategie konzentrieren können, anstatt Daten zu bearbeiten.

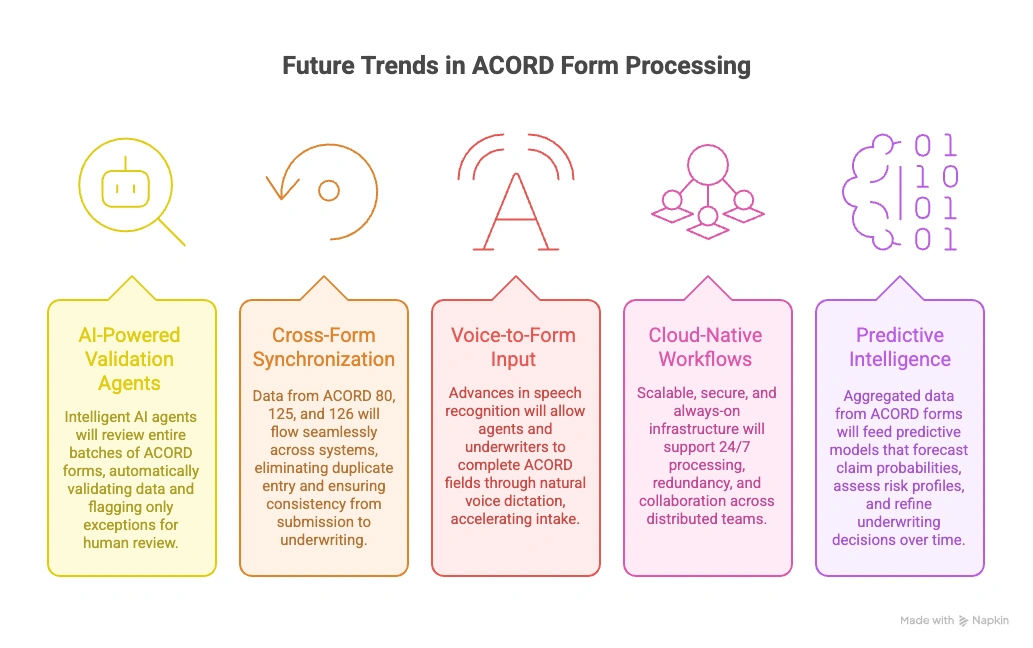

Zukünftige Trends in der ACORD-Formularverarbeitung

The Next Development of the ACORD form management is already in the Gange: The verschmelzung of automation, intelligence and connectivity in all insurance operations.

- KI-gestützte Validierungsagenten: Intelligente KI-Agenten überprüfen den gesamten Stapel von ACORD-Formularen, validieren die Daten automatisch und zeichnen nur Ergebnisse zur menschlichen Überprüfung aus.

- Formelübergreifende Synchronisation: Die Daten von ACORD 80, 125 und 126 werden nahtlos zwischen den Systemen übertragen, wodurch doppelte Eingaben vermieden werden und die Konsistenz der Einreichung bis zum Underwriting gewährleistet wird.

- Eingabe per Spracheingabe in das Formular: Agents and Insurance are possible progress at the language recognition, ACORD fields through natural language dictat, wodurch die Aufnahme beschleunigt wird.

- Cloud-native Workflows: Eine skalierbare, sichere und ständig verfügbare Infrastruktur unterstützt die Verarbeitung, Redundanz und Zusammenarbeit zwischen verteilten Teams rund um die Uhr.

- Prädiktive Intelligenz: Aggregated data from ACORD forms are included in prognosemodels, which are forecast forecast, risk profile evaluate and insurance technology decisions in the time.

Wie vereinfacht Automation ACORD 80?

The manual ACORD 80 processing means often multiple data input, versionskonflikte and long approval cycles. The automation change the.

So funktioniert ein Intelligent Document Processing (IDP) The platform simplify each step from the form eingabe to data validation and compliance.

1. Automatische Erkennung von Formularen

The system identified ACORD 80-forms in the moment, in they arrive, independent from, if they scannt, by email, or loaded. Es klassifiziert Dokumente automatisch und ersetzt stundenlanges manuelles Sortieren.

2. KI-gestützte Datenextraktion

Progressive KI models read the form line for line and extract structured and unstructured data as bewerberdetails, immobilieninformationen and deckungsgrenzen. Dadurch entfällt manuelles Eingeben und menschliche Fehler werden reduziert.

3. Dynamische Anpassung von Vorlagen

Versicherungsträger ändern häufig die ACORD-Layouts. Automationsplattformen erkennen diese Variationen sofort, sodass nicht für jedes Update neue Vorlagen erstellt werden müssen.

4. Integrated Data Validation

Validierungsprüfungen stellen sicher, dass alle Pflichtfelder vollständig und konsistent sind und die versicherungstechnischen und behördlichen Vorschriften entsprechen. This prevent ablehns and minimiert nacharbeiten.

5. Maker-Checker Review zur Qualitätskontrolle

Wenn die KI unsicher ist, durchlaufen markierte Datenpunkte einen Maker-Checker-Workflow. Prüfer bestätigen die Richtigkeit, anstatt die Information erneut einzugeben, sodass der Prozess effizient und transparent bleibt.

6. Kontinuierliches Lernen und Genauigkeitsverfolgung

Mit jeder Korrektur wird das Modell trainiert, sodass es bei zukünftigen ACORD 80-Einreichungen besser abschneidet. With the time rise the quality rates, during the person efforts.

7. Sichere Cloud-basierte Verarbeitung

Jedes verarbeitete Formular wird verschlüsselt und gemäß den Standards SOC 2 und ISO 27001 gespeichert. Auditprotokolle und Versionsverfolgung sorgen für vollständige Transparenz und Datenintegrität.

Kurz gesagt: The Automation does not only ACORD 80-forms, but know, valid and protects they and makes a quick, reliable and testing process from manual work.

Häufig gestellte Fragen zu ACORD 80

F: Wo kann ich ein ausfüllbares ACORD 80-PDF erhalten?

Die meisten Agenturen stellen ihren Kunden ein ausfüllbares PDF zur Verfügung. Branchenformularbibliotheken und Netzbetreiberportale bieten auch ACORD 80-Ausgaben an. Use the edition, the your mobile provider accepted (z. B. 2005/08 or 2012/01).

F: Is ACORD 80 for the offer a house besitzers required?

Die meisten Fluggesellschaften benötigen ACORD 80 oder eine gleichwertige Dosis. The form standardisiert die Daten, sodass Underwriting ohne zusätzliches Hin und Her erfolgen kann.

F: Was ist der Unterschied zwischen ACORD 80 und anderen ACORD-Formen?

ACORD 80 deckt Hausbesitzer ab. ACORD 125 and 126 covers gewerbliche Sparten ab (general app and liability). ACORD 140 deckt Immobilienpläne ab. Jedes Formular dient einem bestimmten Anwendungsfall.

F: Wie lange dauert die ACORD 80-Verarbeitung (manuell oder automatisiert)?

The manual input does often 10-20 minutes per form. Durch die Automatisierung kann die Bearbeitung sauberer digitaler Dateien auf Sekunden reduziert werden, sodass nur markierte Ausnahmen überprüft werden.

F: Can read the automation handschriften and negative scans on ACORD 80?

Ja, mit Handschriftmodellen und Bildbereinigung. Leg the vertrauensschwellen fest, sodass Felder mit niedrigerer Qualität an einen menschlichen Prüfer weitergeleitet werden, während saubere Felder direkt weitergeleitet werden.

F: Welche KPIs belegen den ROI der ACORD 80-Automatisierung?

Verfolgen Sie Genauigkeitsrate, Zeit pro Formular, manuelle Berührungsrate, Kosten pro Formular, Durchsatz und Fehlerrate. Verbesserte Zahlen für diese KPIs zeigen deutliche Geschwindigkeits- und Qualitätszuwächse.

Fazit

ACORD 80 is more as a form. Es ist der erste Handschlag zwischen einem Hausbesitzer und einem Spediteur. Clean data give here the time for the complete policy before. The manual input increased the verzögerung and the risk. Durch die Automatisierung werden Minuten auf Sekunden reduziert, die Genauigkeit wird erhöht und den Führungskräften werden klare Kennzahlen zur Verfügung gestellt. The industry is also provided an cost and access pressure, because speed and klarheit are still important. The way is clear: Ermitteln Sie die Ausgabe, extrahieren Sie die Felder, überprüfen Sie die Regeln und senden Sie saubere Daten an die Systeme, die sie benötigen.

Wenn Ihre Teams immer noch Stapel von PDF-Dateien durchsuchen, ist jetzt ein guter Zeitpunkt, um ein zielgerichtetes Pilotprojekt zu testen. Fangen Sie klein an, messen Sie gründlich und skalieren Sie, was funktioniert. Infred you can help to make the process defined, a straff test path and reduce the warteschlange, their employees have to take more time with risk decisions and less time with the another access.

Häufig gestellte Fragen

Software zur Überprüfung und Prüfung von Hypotheken ist ein Sammelbegriff für Tools zur Automatisierung und Rationalisierung des Prozesses der Kreditbewertung. Es hilft Finanzinstituten dabei, die Qualität, die Einhaltung der Vorschriften und das Risiko von Krediten zu beurteilen, indem sie Kreditdaten, Dokumente und Kreditnehmerinformationen analysiert. Diese Software stellt sicher, dass Kredite den regulatorischen Standards entsprechen, reduziert das Fehlerrisiko und beschleunigt den Überprüfungsprozess, wodurch er effizienter und genauer wird.

IDP verarbeitet effizient sowohl strukturierte als auch unstrukturierte Daten, sodass Unternehmen relevante Informationen aus verschiedenen Dokumenttypen nahtlos extrahieren können.

KI verwendet Mustererkennung und Natural Language Processing (NLP), um Dokumente genauer zu klassifizieren, selbst bei unstrukturierten oder halbstrukturierten Daten.

IDP nutzt KI-gestützte Validierungstechniken, um sicherzustellen, dass die extrahierten Daten korrekt sind, wodurch menschliche Fehler reduziert und die allgemeine Datenqualität verbessert wird.

IDP (Intelligent Document Processing) verbessert die Audit-QC, indem es automatisch Daten aus Kreditakten und Dokumenten extrahiert und analysiert und so Genauigkeit, Konformität und Qualität gewährleistet. Es optimiert den Überprüfungsprozess, reduziert Fehler und stellt sicher, dass die gesamte Dokumentation den behördlichen Standards und Unternehmensrichtlinien entspricht, wodurch Audits effizienter und zuverlässiger werden.

Wählen Sie eine Software, die fortschrittliche Automatisierungstechnologie für effiziente Audits, leistungsstarke Compliance-Funktionen, anpassbare Audit-Trails und Berichte in Echtzeit bietet. Stellen Sie sicher, dass sie sich gut in Ihre vorhandenen Systeme integrieren lässt und Skalierbarkeit, zuverlässigen Kundensupport und positive Nutzerbewertungen bietet.