Stellen Sie sich vor, Ihr Schreibtisch ist voller Papiere, Rechnungen, Verträge, Formulare, Ausweise und ein paar Haftnotizen, die sich auf mysteriöse Weise über Nacht vermehren. Stellen Sie sich nun vor, dass der gesamte Stapel digitalisiert, kategorisiert und dorthin weitergeleitet wird, wo er hingehört, noch bevor Sie Ihren ersten Kaffee getrunken haben. Das ist das Versprechen von Automatisierung des Workflows zum Scannen von Dokumenten im Jahr 2025. Es geht nicht mehr nur darum, Papier zu digitalisieren; es geht darum, jedes Dokument intelligenter, durchsuchbar und nahtlos mit Ihren Geschäftsprozessen zu verbinden.

Was ist Workflow-Automatisierung beim Scannen von Dokumenten?

Die Workflow-Automatisierung beim Scannen von Dokumenten ist der Prozess, bei dem mithilfe von Technologie physische und digitale Dokumente digitalisiert, die darin enthaltenen Informationen extrahiert und diese Daten automatisch durch Geschäftsabläufe übertragen werden. Anstatt dass eine Person manuell Zahlen aus einer Kreditakte eingibt oder Versicherungsformulare Zeile für Zeile überprüft, scannen, erkennen, validieren und leiten Automatisierungstools Informationen weiter.

Stellen Sie sich das wie eine Hochgeschwindigkeitsmontagelinie vor: Papiere kommen rein, Daten werden verarbeitet und Daten fließen heraus, sofort einsatzbereit.

Beispiele für Workflows zum Scannen von Dokumenten

- Hypothekengeber scannen ganze Kreditdateien (Tausende von Seiten pro Kreditnehmer) und überprüfen sie automatisch auf fehlende Unterschriften.

- Versicherer, die Schadensdokumente bearbeiten.

- Finanzteams scannen Rechnungen, extrahieren Zahlungsdetails und synchronisieren sie mit Buchhaltungssystemen.

- Ingenieure digitalisieren technische Zeichnungen und Schaltpläne und verwandeln Baupläne in nutzbare Daten für Konstruktion und Fertigung.

Traditionelle Workflow-Automatisierung beim Scannen von Dokumenten im Vergleich zur intelligenten Workflow-Automatisierung beim Scannen von Dokumenten

Nicht jede Automatisierung zum Scannen von Dokumenten ist gleich. Herkömmliche Tools zur Automatisierung von Arbeitsabläufen zum Scannen von Dokumenten konzentrieren sich hauptsächlich auf die Digitalisierung von Papier und die Umwandlung von Dateistapeln in PDF-Dateien oder durchsuchbaren Text mit einfacher OCR-Funktion. Auf diese Weise wird zwar das Papiergewirr reduziert, doch oft reicht es nicht aus, tiefgreifendere Herausforderungen wie Validierung, Compliance und intelligentes Routing zu lösen.

Die intelligente Workflow-Automatisierung beim Scannen von Dokumenten geht dagegen mehrere Schritte weiter. Es kombiniert KI, maschinelles Lernen und erweiterte Validierungsregeln, um Daten automatisch zu extrahieren, zu überprüfen und in Geschäftssysteme zu integrieren. Das Ergebnis sind nicht nur digitale Dokumente, sondern verwertbare Informationen, die Sie als Grundlage für Geschäftsentscheidungen verwenden können.

Vorteile der Workflow-Automatisierung beim Scannen von Dokumenten

Dokumente auf die altmodische Art zu bearbeiten ist wie der Versuch, durch Schlamm zu sprinten. Irgendwann werden Sie dort ankommen, aber langsam und mit viel verschwendeter Energie. Automatisierung des Workflows zum Scannen von Dokumenten macht diesen Weg frei. Es digitalisiert nicht nur Dateien, es wandelt sie in nutzbare Daten um, die sich schnell und genau durch Ihre Systeme bewegen. Die Vorteile sind kaum zu ignorieren: schnellere Bearbeitung, geringere Kosten, weniger Fehler und bessere Compliance. Kurz gesagt, es macht den Unterschied zwischen der ständigen Bekämpfung von Papierkram und dem problemlosen Informationsfluss dorthin, wo sie benötigt werden.

- Zeit- und Kostenersparnis

Die manuelle Dateneingabe ist teuer. Unternehmen geben jährlich Millionen aus, nur für die Eingabe von Informationen. Die intelligente Workflow-Automatisierung für das Scannen von Dokumenten reduziert die Kosten, indem die Anzahl der sich wiederholenden Arbeiten reduziert wird. Unternehmen, die mit Infrrd IDP von der manuellen zur fortschrittlichen Dokumentenverarbeitung umgestiegen sind, haben festgestellt, dass die Verarbeitungsgeschwindigkeiten um das bis zu 60-fache ihrer ursprünglichen Zeit gestiegen sind.

Sie möchten mehr über diesen Anwendungsfall erfahren? Sprechen Sie direkt mit unseren KI-Experten. Buchen Sie jetzt einen Anruf.

- Genauigkeitsverbesserungen und Fehlerreduzierung

Menschen machen Fehler: Zahlen werden falsch gelesen, Felder übersprungen oder Ziffern transponiert. Die Automatisierung reduziert diese Risiken, indem sie einheitliche Regeln und Prüfungen anwendet. Eine Person könnte zwar eine fehlende Seite in einer 500-seitigen Hypothekendatei übersehen, aber ein automatisierter Arbeitsablauf kann diese Fehler drastisch reduzieren.

- Konformität und Auditbereitschaft

Compliance ist in Branchen wie Hypotheken, Finanzen und Versicherungen ein entscheidender Faktor. Standards wie FADGI (Initiative der Bundesbehörden für digitale Richtlinien) und Metamorphose bieten Maßstäbe für die Qualität der Digitalisierung. Automatisierte Workflows helfen Unternehmen dabei, revisionssicher zu bleiben, indem sie rückverfolgbare Protokolle generieren, vollständige Dateisätze sicherstellen und Audit-Trails ohne zusätzlichen Aufwand erstellen.

- Höherer ROI

Die intelligente Workflow-Automatisierung beim Scannen von Dokumenten kann den ROI erheblich steigern, da zusätzliche Schritte, die Prozesse verlangsamen, entfallen. Branchenanalysen zeigen einen durchschnittlichen ROI von 200—30% mehr als drei Jahre nach der Implementierung intelligenter Scans, wobei sich viele Unternehmen in weniger als einem Jahr amortisieren.

So funktioniert die Workflow-Automatisierung beim Scannen von Dokumenten

Die Umwandlung eines papierlastigen Workflows in einen reibungslosen, automatisierten Prozess mag kompliziert klingen, aber die Schritte sind überraschend einfach. Der genaue Ablauf kann von Tool zu Tool variieren, aber die Grundlagen bleiben dieselben. Im Folgenden finden Sie eine Aufschlüsselung, wie Automatisierung des Workflows zum Scannen von Dokumenten funktioniert normalerweise:

Aufnahme und Bildvorbereitung

Jeder Arbeitsablauf beginnt mit der Aufnahme: Scanner oder digitale Uploads. Dann beginnt die Bildvorbereitung — das Entziehen geneigter Seiten, das Entfernen von Flecken und die bessere Lesbarkeit handgeschriebener Notizen. Dieser Schritt stellt sicher, dass die nachgelagerten Prozesse saubere, qualitativ hochwertige Inputs erhalten.

OCR/ICR und Datenextraktion

Optische Zeichenerkennung (OCR) liest gedruckten Text. Die intelligente Zeichenerkennung (ICR) geht bei der Entschlüsselung der Handschrift noch einen Schritt weiter. Zusammen übertragen sie Informationen aus gescannten Bildern in strukturierte Datenformate. Stellen Sie sich das als die „Augen und das Gehirn“ des Prozesses vor.

Dokumentenübergreifende Validierung und Versionskontrolle

Hier passiert die Magie. Automatisierung tut nicht nur Daten erfassen; es überprüft Beziehungen zwischen Dokumenten. Zum Beispiel:

- Entspricht das auf einem W-2 angegebene Einkommen des Kreditnehmers dem Hypothekenantrag?

- Stimmt der Schadenbetrag mit den Belegen in einer Versicherungsakte überein?

- Werden die neuesten Versionen der technischen Zeichnungen verwendet?

Human-in-the-Loop- und Maker-Checker-Validierung

Die Automatisierung erledigt die Schwerarbeit, aber die Mitarbeiter greifen immer noch dort ein, wo Urteilsvermögen gefragt ist. Die Workflows für die Macher-Checker-Validierung ermöglichen es einer Person (dem Ersteller), Daten einzugeben oder zu bestätigen, und eine andere (der Prüfer), sie zu genehmigen. Die Automatisierung reduziert den Umfang der Prüfungen, lässt aber bei Bedarf Spielraum für die Überwachung.

Integration mit Geschäftssystemen

Der letzte Schritt: Daten fließen in Systeme wie Kreditvergabe Software (LOS), ERP-, CRM- oder Buchhaltungstools. Keine manuellen Uploads. Kein Ausschneiden und Einfügen. Einfach nahtlose Integration.

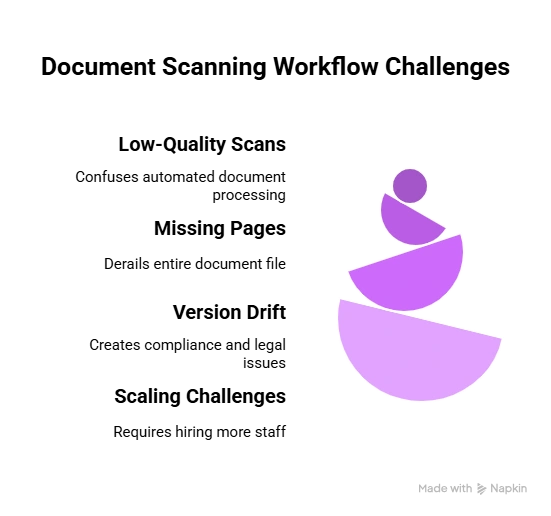

Die wichtigsten Herausforderungen bei Workflows zum Scannen von Dokumenten

Selbst die intelligentesten Automatisierungstools können stolpern, wenn sie mit unordentlichen Dokumenten aus der realen Welt konfrontiert werden. Von verschwommenen Scans und Macken bei der Handschrift bis hin zu fehlenden Seiten und veralteten Versionen — diese Hürden können selbst die effizientesten Arbeitsabläufe verlangsamen. Verständnis der häufigsten Herausforderungen in Automatisierung des Workflows zum Scannen von Dokumenten ist der erste Schritt, um sie zu reparieren, bevor sie Ihren Prozess zum Scheitern bringen:

Scans, Handschriften und Stempel von geringer Qualität

Nicht jedes Dokument ist ein gestochen scharfes PDF. Verschwommene Scans, Kaffeeflecken, Handschriften und offizielle Stempel können Systeme verwirren. Moderne KI-geschulte OCR-Engines bewältigen diese besser, benötigen aber immer noch Ausweichprozesse.

Fehlende Seiten und Versionsabweichung

In Branchen wie Hypotheken oder Baugewerbe kann eine fehlende Seite eine ganze Datei zum Scheitern bringen. Versionsabweichungen — wenn veraltete Formulare verwendet werden — führen zu Problemen bei der Einhaltung der Vorschriften. Durch die Automatisierung werden diese Probleme frühzeitig erkannt und kostspielige Verzögerungen vermieden.

Skalierung ohne Erhöhung der Mitarbeiterzahl

Die größte Herausforderung? Lautstärke. Hypothekengeber, Versicherer und Hersteller haben täglich mit Zehntausenden von Dokumenten zu tun. Um den Betrieb manuell zu skalieren, müssen Armeen von Mitarbeitern eingestellt werden. Die Automatisierung ermöglicht eine Skalierung ohne zusätzliches Personal.

Warum Unternehmen jetzt Scan-Workflows automatisieren

Der Zeitpunkt ist kein Zufall. Die meisten Daten, die heute verarbeitet werden, sind unstrukturiert und in PDF-Dateien, Bildern und Formularen gespeichert. Gleichzeitig nimmt die behördliche Kontrolle zu, und die Kunden erwarten eine schnellere Bearbeitung.

Und die Marktzahlen bestätigen es:

- Das globaler Markt für Dokumentenscanning-Dienste wurde mit etwa bewertet 7,3 Milliarden $ im Jahr 2024, wächst um 8,2% jährlich.

- Nordamerika ist wegweisend, was fast 38% des globalen Marktes für Scan-Workflow-Automatisierung im Jahr 2024.

- Im Durchschnitt sehen Unternehmen, die Scanautomatisierung einführen, eine ROI von 200— 300% über drei Jahre, wobei viele ihre Investitionen zurückerhalten haben unter 12 Monaten.

Unternehmen können sich keine Engpässe leisten, die durch manuelle Überprüfungen verursacht werden. Automatisierung ist kein Luxus mehr, sie ist Überleben.

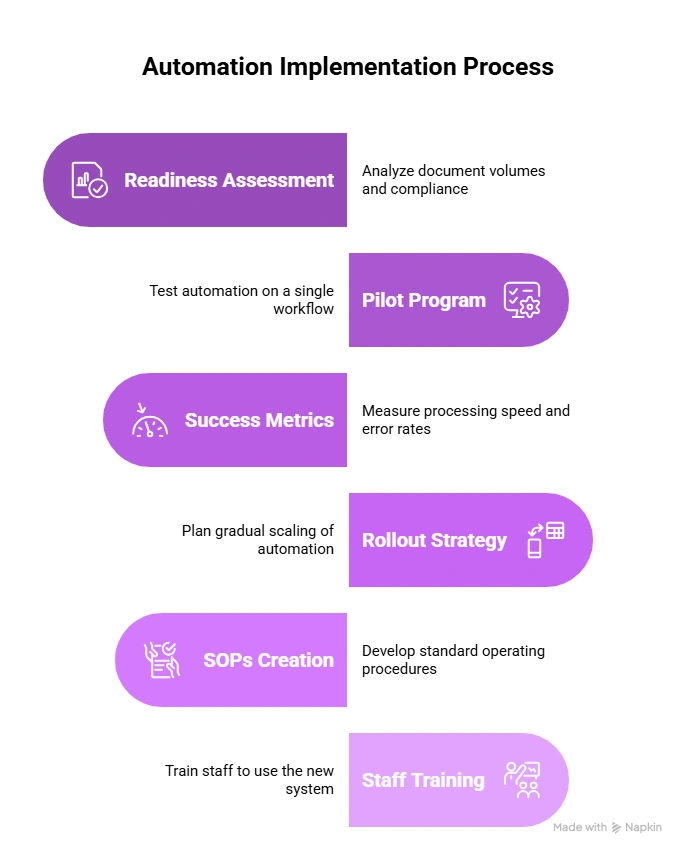

Implementierungscheckliste für die Automatisierung

Rollout Automatisierung des Workflows zum Scannen von Dokumenten geht es nicht nur darum, das richtige Tool auszuwählen — es geht darum, die Reise so zu planen, dass sie echte Ergebnisse liefert. Eine durchdachte Implementierung stellt sicher, dass Sie nicht nur Aufgaben automatisieren, sondern auch die Geschwindigkeit, Genauigkeit und Compliance Ihrer Prozesse verbessern. Die folgende Checkliste beschreibt die wichtigsten Schritte, um Ihr Team vorzubereiten, den Ansatz zu testen und die Automatisierung mit Zuversicht zu skalieren.

Bewertung der Eignung (Dokumentenvolumen, SLAs)

Analysieren Sie zunächst Ihr Dokumentenvolumen, Ihre Service Level Agreements und Ihre Compliance-Anforderungen. Wie viel Prozent Ihrer Prozesse sind immer noch manuell? Wo treten Fehler am häufigsten auf?

Pilotprogramm und Erfolgskennzahlen

Spring nicht blind rein. Führen Sie ein Pilotprojekt für einen einzelnen Workflow durch, z. B. für die Rechnungsbearbeitung oder den Eingang von Schadensfällen. Messen Sie den Erfolg anhand von Kennzahlen wie Verarbeitungsgeschwindigkeit, Fehlerquoten und Kosteneinsparungen.

Einführungsstrategie und Unternehmensführung

Sobald der Pilot seinen Wert bewiesen hat, skalieren Sie schrittweise. Definieren Sie Governance-Richtlinien, erstellen Sie klare SOPs und schulen Sie die Mitarbeiter in der Interaktion mit der Automatisierung. Eine klare Kommunikation hilft, Widerstände zu vermeiden und stärkt das Vertrauen in das neue System.

ROI und geschäftliche Auswirkungen der Workflow-Automatisierung beim Scannen von Dokumenten

Kostensenkungen und Effizienzsteigerungen

Unternehmen rechnen in der Regel mit einer Amortisationszeit von weniger als einem Jahr. Geringere Personalkosten, geringere Fehlerraten und weniger Papierspeicher summieren sich schnell.

Durchsatz- und Genauigkeitsmetriken

Die Automatisierung ermöglicht es Unternehmen, das Doppelte, manchmal das Dreifache zu verarbeiten — das Volumen ohne zusätzliches Personal. Kennzahlen wie Dokumente pro Stunde, Fehlerraten und eingesparte Minuten für Prüfer werden zu den neuen Leistungsmaßstäben.

Erstellung eines Geschäftsszenarios

Führungskräfte reagieren auf Zahlen. EIN starker ROI Der Fall sollte beinhalten:

- Zeitersparnis pro Dokument

- Kosteneinsparungen durch weniger Fehler

- Reduzierung des Compliance-Risikos

- Fähigkeit, Wachstum ohne Neueinstellungen zu bewältigen

Wie Infrarot Arbeitsabläufe bei der Dokumentenverarbeitung automatisieren kann

Infrarot Intelligente Dokumentenverarbeitung Die (IDP) -Plattform vereint KI und Workflow-Automatisierung, um die manuelle Bearbeitung von Dokumenten zu vereinfachen. Mit seiner Modell für berührungslose Verarbeitung, Dateien werden nicht nur gescannt, sondern auch verstanden, validiert und in nutzbare Daten umgewandelt.

Das IDP von Infrrd basiert auf ML/KI, intelligenter Klassifizierung, dokumentenübergreifender Prüfungen und agentischer KI und bietet schnellere Bearbeitungszeiten, höhere Genauigkeit und Ergebnisse, die für die Einhaltung der Vorschriften geeignet sind. Und weil die Plattform ständig lernt und sich anpasst, lässt sie sich problemlos an wachsende Dokumentenmengen anpassen und reduziert gleichzeitig menschliche Eingriffe auf ein Minimum.

Um zu erfahren, wie KI Ihre Dokumente transformiert, vereinbaren Sie einen Anruf mit unseren Experten und sehen Sie sich die Ergebnisse live an. Buchen Sie noch heute Ihren Anruf.

Auf den Punkt gebracht

Bei der Automatisierung des Workflows zum Scannen von Dokumenten im Jahr 2025 geht es nicht nur darum, papierlos zu werden. Es geht um intelligenter, schneller und mit weniger Fehlern arbeiten. Unternehmen, die jetzt automatisieren, sparen nicht nur Kosten, sondern behalten auch in Bezug auf Compliance und Kundenerlebnis die Nase vorn.

Die Frage ist nicht wenn du solltest automatisieren, es ist wie schnell.

Häufig gestellte Fragen zur Workflow-Automatisierung beim Scannen von Dokumenten

F: Was ist ein Arbeitsablauf zum Scannen von Dokumenten?

Ein Workflow zum Scannen von Dokumenten ist der komplette, durchgängige Prozess der Erfassung, Digitalisierung und Weiterleitung von Informationen aus physischen oder digitalen Dokumenten in Geschäftssysteme. Er umfasst in der Regel das Scannen, die Bildbereinigung, die Texterkennung, die Datenextraktion, die Validierung und die sichere Speicherung. Ziel ist es, unstrukturierte Daten in strukturierte, durchsuchbare und verwertbare Informationen umzuwandeln, die sich nahtlos in die Unternehmensabläufe integrieren lassen.

F: Wie automatisiert man das Scannen von Dokumenten?

Die Automatisierung des Scannens von Dokumenten kombiniert Scanhardware, OCR-Software (Optical Character Recognition) oder ICR-Software (Intelligent Character Recognition), KI-gestützte Validierung und Tools zur Workflow-Automatisierung. Zusammen identifizieren diese Komponenten wichtige Felder, erkennen Fehler, kennzeichnen Ausnahmen und leiten Daten automatisch an nachgelagerte Systeme wie ERP-, CRM- oder Dokumentenmanagement-Plattformen weiter, wodurch manuelle Eingriffe überflüssig werden und die Bearbeitungszeit beschleunigt wird.

F: Was sind Best Practices für die Scanautomatisierung?

Effektive Scanautomatisierung beginnt mit qualitativ hochwertigen Scans mit zuverlässigen Geräten und konsistenten Einstellungen. Die Durchführung kleiner Pilotprojekte hilft dabei, potenzielle Probleme mit der Datenqualität frühzeitig zu erkennen. Die Teams sollten die Genauigkeit messen, Benchmark-KPIs festlegen und den Prozess anhand definierter Governance-Richtlinien, einschließlich Zugriffskontrolle, Audit-Trails und Versionsverwaltung, schrittweise skalieren.

F: Welche Standards gibt es für die Qualität der Digitalisierung (FADGI, Metamorfoze)?

FADGI (Federal Agencies Digital Guidelines Initiative) und Metamorfoze sind international anerkannte Frameworks, die Maßstäbe für die Bildqualität für die Digitalisierung definieren. Sie beschreiben Standards für Farbgenauigkeit, Auflösung, Tonwertwiedergabe und Aufbewahrung von Metadaten, um sicherzustellen, dass digitalisierte Dateien die Archivierungs-, Rechts- und Compliance-Anforderungen für eine langfristige Nutzung erfüllen.

F: Was sind die häufigsten Herausforderungen bei Scan-Workflows?

Zu den häufigsten Hindernissen gehören schlechte Scanqualität, fehlende oder falsch ausgerichtete Seiten, Versionsinkongruenzen und Schwierigkeiten bei der Verwaltung großer Dokumentenmengen ohne Personalaufstockung. Darüber hinaus können inkonsistente Vorlagen, veraltete Systeme und manuelle Validierungsschritte den Prozess weiter verlangsamen und die Gesamtgenauigkeit verringern.

F: Was sind die Hauptanwendungsfälle der Automatisierung von Scan-Workflows?

Die Automatisierung von Scan-Workflows wird branchenübergreifend häufig für Prozesse wie die Digitalisierung von Hypothekendarlehensakten, die Bearbeitung von Versicherungsansprüchen, die Rechnungsverarbeitung, das Vertragsmanagement, die Archivierung von Personalakten, die Digitalisierung technischer Zeichnungen und die Compliance-Dokumentation eingesetzt. Diese Workflows profitieren von der Automatisierung durch schnellere Bearbeitungszeiten, verbesserte Datenzuverlässigkeit und geringere Betriebskosten.

Häufig gestellte Fragen

Software zur Überprüfung und Prüfung von Hypotheken ist ein Sammelbegriff für Tools zur Automatisierung und Rationalisierung des Prozesses der Kreditbewertung. Es hilft Finanzinstituten dabei, die Qualität, die Einhaltung der Vorschriften und das Risiko von Krediten zu beurteilen, indem sie Kreditdaten, Dokumente und Kreditnehmerinformationen analysiert. Diese Software stellt sicher, dass Kredite den regulatorischen Standards entsprechen, reduziert das Fehlerrisiko und beschleunigt den Überprüfungsprozess, wodurch er effizienter und genauer wird.

Eine QC-Checkliste vor der Finanzierung besteht aus einer Reihe von Richtlinien und Kriterien, anhand derer die Richtigkeit, Einhaltung und Vollständigkeit eines Hypothekendarlehens überprüft und verifiziert werden, bevor Mittel ausgezahlt werden. Sie stellt sicher, dass das Darlehen den regulatorischen Anforderungen und internen Standards entspricht, wodurch das Risiko von Fehlern und Betrug verringert wird.

KI verwendet Mustererkennung und Natural Language Processing (NLP), um Dokumente genauer zu klassifizieren, selbst bei unstrukturierten oder halbstrukturierten Daten.

Ja, IDP kann Dokumenten-Workflows vollständig automatisieren, vom Scannen über die Datenextraktion und Validierung bis hin zur Integration mit anderen Geschäftssystemen.

Eine QC-Checkliste vor der Finanzierung ist hilfreich, da sie sicherstellt, dass ein Hypothekendarlehen vor der Finanzierung alle regulatorischen und internen Anforderungen erfüllt. Das frühzeitige Erkennen von Fehlern, Inkonsistenzen oder Compliance-Problemen reduziert das Risiko von Kreditmängeln, Betrug und potenziellen rechtlichen Problemen. Dieser proaktive Ansatz verbessert die Kreditqualität, minimiert kostspielige Verzögerungen und stärkt das Vertrauen der Anleger.

Wählen Sie eine Software, die fortschrittliche Automatisierungstechnologie für effiziente Audits, leistungsstarke Compliance-Funktionen, anpassbare Audit-Trails und Berichte in Echtzeit bietet. Stellen Sie sicher, dass sie sich gut in Ihre vorhandenen Systeme integrieren lässt und Skalierbarkeit, zuverlässigen Kundensupport und positive Nutzerbewertungen bietet.